a Gente Realiza!

Many pioneer companies went for Initial public offerings in the past. Companies and government entities sell the shares and stocks to fund business expansion and advancements following the IPO. It consists of agricultural-based activities secondary sales meaning and is also known as the Agricultural and allied sector. It utilises natural resources of the environment and produces crops, minerals, livestock etc. The products of the Primary industry become the input for the secondary industry.

Stocks on the secondary market are traded multiple times at a price determined by the market forces, unlike in the primary market. Investors can ease their liquidity problems in a secondary market conveniently. Like, an investor in need of liquid cash can sell the shares held quite easily as a large number of buyers are present in the secondary market. Secondary market transactions provide liquidity to all kinds of investors. Due to high volume transactions, their costs are substantially reduced.

The companies can give securities to a group of investors, irrespective of their listing in the stock market. It includes paying dividends to preference shareholders before ordinary shareholders. When a company decides to issue securities only to a limited number of investors, it is known as Private Placement. The small group of investors can have institutions as well as individuals.

The initial public offering policy is used to issue shares to a large crowd. Coal India went for an initial public offering in 2010, and it raised over INR 15,000 crores. To the investors, there was a discount of 5 per cent on the final price of the IPO. Unsold shares sold in the marketplace are one of the primary functions of underwriting services. Financial institutions earn commission by often playing the role of an underwriter. The primary industry lays the foundation for the other two industries.

The employees or workers of the tertiary industry are also known as white-collar workers. Compared to the primary industry, the Secondary industry is complex and operates at a high level. It includes industries that are involved in construction and manufacturing.

For a manufacturer, secondary sales are more important than primary sales because if the secondary sale does not happen, then the primary sales will not happen. Tertiary Sales: Tertiary sales are the final level of sales observed in a company. This happens when the retailer sells the product to the final consumer.

A company may implement controls to stop the devaluing of its stock, which could affect future investment in the company. The secondary markets can in no circumstance supply additional funds since the company is not involved in the transaction. The stock exchanges have physical existence and located in particular geographical areas.

EV battery company Pointo raises $3 million fundingEV battery start-up Pointo has raised $3 million funding from investors for its expansion into 20 districts of West Bengal. The EV company, backed by Mufin finance, said that 4MW li-ion batteries will be deployed in West Bengal by 2024. Here is a list to illustrate the pros and cons of both primary and secondary properties.

A secondary sale is the sale by an existing stockholder of shares in a private company to a third party that does not occur in connection with an acquisition of the company. When a lot of secondary sales happen together as part of the same transaction, it is sometimes referred to as a liquidity round.

The result is an instantaneous increase in the number of incoming queries. Even after following all the previous steps, there is no guarantee that everything will go according to plan. Every retailer or the shopkeeper is a vital influencer in the sales funnel and there can be many reasons why they might be favouring one product over another.

Only buying of securities takes place in the primary market, securities cannot be sold there. There is the trading of existing shares only that have already been floated in the primary market. Capital markets refer to a platform where the trading of various assets like bonds, equity, and securities takes place. Capital markets are mainly divided into two types- Primary Markets and Secondary Markets. Price fluctuations are very high in secondary markets, which can lead to a sudden loss.

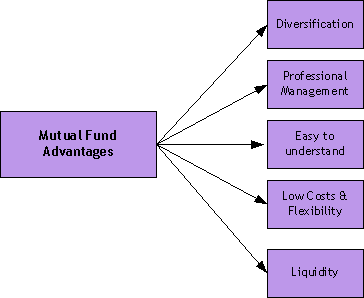

This is a platform where investors trade among themselves with the shares that they own. Since there is no regulatory authority or compulsion involved with this manner of trading, the counterparty risks in over the counter trading are typically high. Also, there is no standardization of share prices, since it varies from one owner to another . Hence, individual investors buy individual stocks or invest in mutual funds through retirement or brokerage accounts. Secondary market sales purchase mutual funds, individual stocks, and exchange-traded funds through retirement or brokerage accounts. In simple words, these market deals with buying and selling of shares.

If a private company wants to go for an initial public offering, it must face multiple enquiries from SEBI . To ensure authenticity, India’s Securities and Exchange Board closely follows the IPO and the firm before going for an IPO. Leveraging investors as they have to pay less for the purchase than the secondary market.

However, unlike shares, most bonds aren’t traded within the secondary market via exchanges. The secondary market is the place securities are traded after the company has offered its offering on the primary market. Today, it is highly sophisticated and uses superior technologies to provide actual-time prices of any share. The stock market consists of exchanges or OTC markets by which shares and different monetary securities of publicly held companies are issued and traded. After buying mortgages on the secondary market, Fannie Mae pools them to form mortgage-backed securities .

Earnings from such offerings are used for company financing, acquisitions, and other business purposes. In the secondary market, investors buy and sell the shares of listed companies directly. The company does not issue new shares, nor does it receive any additional capital. A key difference in the primary market is that a primary market is only concerned with the transactions where the issuing company issues a public offering to the investors for the first time.

Other types of secondary markets exist in addition to stocks, which are one of the most commonly traded securities. Mutual funds and bonds are bought and sold on secondary markets by investment banks, corporations and individuals. Secondary market mortgages are also purchased by Fannie Mae and Freddie Mac. Private companies considering financing can choose to sell their shares to investors through an initial public offering . As the name implies, an IPO is the first time a company goes public — offering its shares to the public. These are essentially new securities sold to investors in the primary market.

Based on past performances and expected growth, ASM and RSM need to allocate the resources to attain optimal results. It is easy to understand that Secondary Sales is important since it acts as an instrument of direct demand creation for the company. But this also means that it is often outside the purview of control of the company and depends on the performance of distributors and the perseverance of the sales team to push the product to the market. The primary market is a financial market where companies launch their securities. Similarly, only accredited investors are allowed to avail the private placements.

Transactions can be entered into at any time, and the market allows for active trading so that there can be immediate purchase or selling with little variation in price among different transactions. Also, there is continuity in trading, which increases the liquidity of assets that are traded in this market. Primary sales refer to sales from the first stakeholder—a manufacturing company or national supplier to a distributor. In other words, the transaction between a manufacturing company/national supplier to a distributor in one city/state/region called “primary sales” transaction. A company makes an invoice of the product at distributor price and the revenue from the transaction is the net revenue of the company.

Secondary markets preserve energetic trading so that investors should buy or sell instantly at a price that varies little from transaction to transaction. Continuous buying and selling growing the liquidity of the assets traded in the secondary markets. Many pension funds and different institutional buyers have diversification rules limiting the proportion of their total funding portfolios that may be allotted to non-public fairness investments. Therefore, many such investors are pressured to sell private equity and other alternative investments to be able to rebalance their portfolios. Before diving into what is a secondary offering of shares, let’s quickly recap the basics regarding primary and secondary markets. In the primary market, companies issue new shares in cash to investors.

Secondary Sales – When a distributor invoices the product to a retailer, the transaction is called as 'Secondary Sales'. In this transaction, distributor keeps its margin and invoices the product at dealer price (also called as retailer price).

Trading in secondary markets does not require a hefty amount, thus facilitating investments of small ticket investors. Before buying or selling in a secondary market, investors have to duly complete the procedures involved, which are usually a time-consuming process. Dealer market is another type of secondary market in which various dealers indicate prices of specific securities for a transaction. Foreign exchange trade and bonds are traded primarily in a dealer market.

Buyers seek to accumulate non-public fairness interests within the secondary marketplace for multiple causes. For instance, the duration of the investment could also be a lot shorter than an funding within the private equity fund initially. The process of secondary sales is one of the critical beasts to handle and involves the management of numerous disparate variables. This is the essential side-effect of placing a primary business goal in the hands of external agents. With the above-highlighted practices, Secondary Sales can be potentially turned into a powerhouse of revenues for an organization. Companies regularly launch new products and some of them take off and are successful, others fail.

In a primary market, the investors purchase securities directly from the issuing company. Some of these products are shares, debentures, derivatives and warrants. The buying and selling of securities happen between the investors and issuing companies. Organisations can obtain financing for their businesses in a cost-effective and seamless manner. Additionally, securities are often presented in the primary market, which can nearly be immediately sold in the optional secondary market, subsequently giving high liquidity.

The secondary market is what you typically know as the common stock market. This is the space where investors trade in the market securities they own. There is no intervention of the issuing company in the secondary stock market . In short, you can think of the secondary market as being analogous to a marketplace where sellers sell branded goods to buyers . The secondary market allows an investor to purchase or sell stocks and bonds to another investor.

The mortgage market is a good example to use when discussing the secondary market, as it is another security that is commonly traded on the secondary market. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest.